Honda Enters Indian E2W Market; KTM Self-Administration; Damon Under Pressure; Ola's New Mopeds

InsightEV Daily Update

The Indian market is the world's second most exciting electric two-wheeler market (we rate Africa higher). The roughly 1.2 million-unit market has been divided between new players like Ola Electric and Ather Energy and ICE incumbents TVS, Bajaj, and Hero MotoCorp. One name has been missing in action—Honda.

That changed today as Honda India unveiled two electric scooters. Both look very similar, with only slight visual differences. However, they are quite different in construction and specs.

While this was a product unveiling, the scooters will go on sale next year. They will be manufactured at Honda’s Narsapura (Karnataka) plant, which has a total capacity of 2.4m units, split between EV and ICE.

Honda plans to offer battery swap services in Bangalore, Delhi, and Mumbai.

Impact

Honda is a late entrant, and the unveiled scooters and their specs appear quite lackluster compared to scooters from Ola and Ather. However, Honda has always played conservatively in the Indian market, even for the scooter's styling. While Europe and other markets get the CUV e, the Indian market has the Activa e, which has a deliberately toned-down styling.

Any Honda launch has to be considered in light of its overall plans in India. Honda has complete dominance in the Indian (and ASEAN) scooter markets and arguably knows the customer better than everyone else. The prices have not been announced, but customers will likely get a battery leasing and swap option, which would make the proposition interesting.

KTM to apply for judicial restructuring

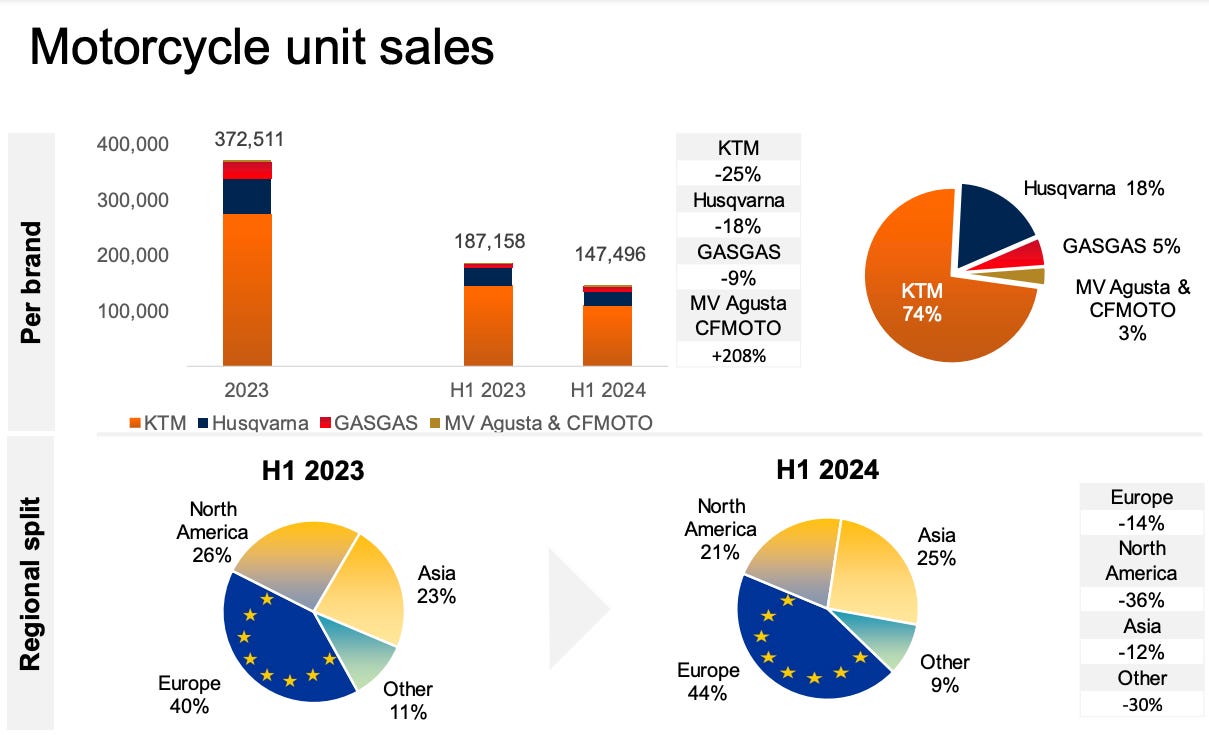

Yesterday afternoon (GMT), Pierer Mobility AG, KTM's parent company, announced that it is preparing an application for judicial restructuring proceedings with self-administration. This is seen as a defense against forced liquidation that the company may face soon. KTM needs finance amounting to a high three-digit million EUR figure. This application indicates that management does not expect to be able to secure the necessary interim financing in time. KTM continues to suffer from high inventories at the OEM and dealer levels.

Things have changed fast for Pierer Mobility. The Austria-listed Pierer Mobility AG had a record 2023—revenues of EUR 2.66bn, EBITDA of EUR 323.5m, and motorcycle sales of over 381k units. Even though margins were down and EBITDA declined by 15 percent below 2022, these were fabulous results by any count in an increasingly difficult environment—Russia had invaded Ukraine, and Europe was slowing down yet again. KTM’s product pipeline remained strong, and the iconic historic brand MV Agusta was acquired only two weeks back.

Pierer Mobility would even announce a dividend of EUR 0.5/share, a share trading around EUR 50 at that time.

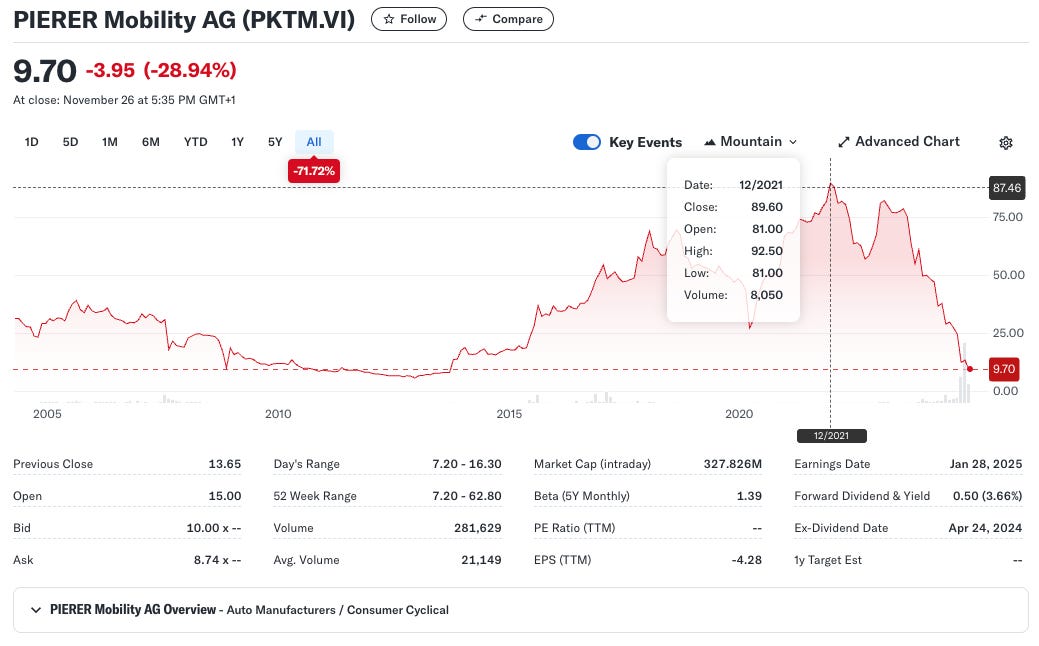

That share is now down to EUR 9.7 as of yesterday's close of trade, and KTM is in trouble.

The European and North American markets for expensive lifestyle motorcycles are under pressure as customers clamp down on discretionary purchases. KTM has been a victim as sales have slowed drastically over the last three quarters. Quality problems also plagued the company as customers reported issues with the camshafts of the LC8C engines on the 790/890 models. The company was late in addressing the problems.

Pierer Mobility AG had a bad first half of the year, so it canceled the 2024 guidance and reduced the executive board to two from six, removing Hubert Trunkenpolz (the T in KTM) from the board.

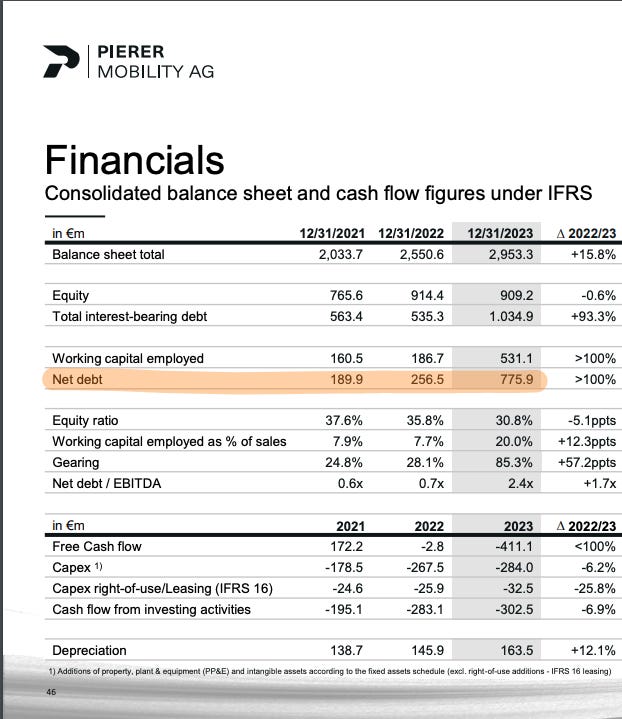

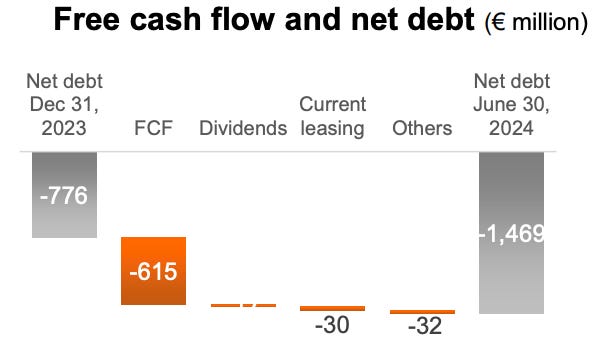

Mounting debt is one of the bigger problems—at the end of 2023, Pierer Mobility’s debt had reached EUR 776m, a sharp spike from EUR 190m in 2021.

This had nearly doubled to EUR 1.5bn at the close of H1 2025. Pierer Mobility attributes the increase in debt to an increase in working capital, which supports its dealers and suppliers and cushions them from increased interest rates.

H1 2024 was also when sales collapsed across the brands.

The media has been speculating on the savior since KTM’s financial problems came to light. India-based Bajaj Auto, a 49.9 percent shareholder in Pierer AG and long-term partner, is the top choice. Bajaj is flush with cash but has not yet made a move.

Austrian businessman and Red Bull heir Mark Mateschitz was also rumored to be interested in investing in KTM, but Pierer Mobility has since denied the rumors.

Impact

Bajaj must save them, or the European and global performance market will change dramatically. Any KTM collapse would likely speed up the Chinese domination of the global power sports market. If Bajaj saves them, owning KTM would also change the play in the Indian and European E2W markets. We would revisit this subject in a weekly analysis soon.

DMN Under Pressure

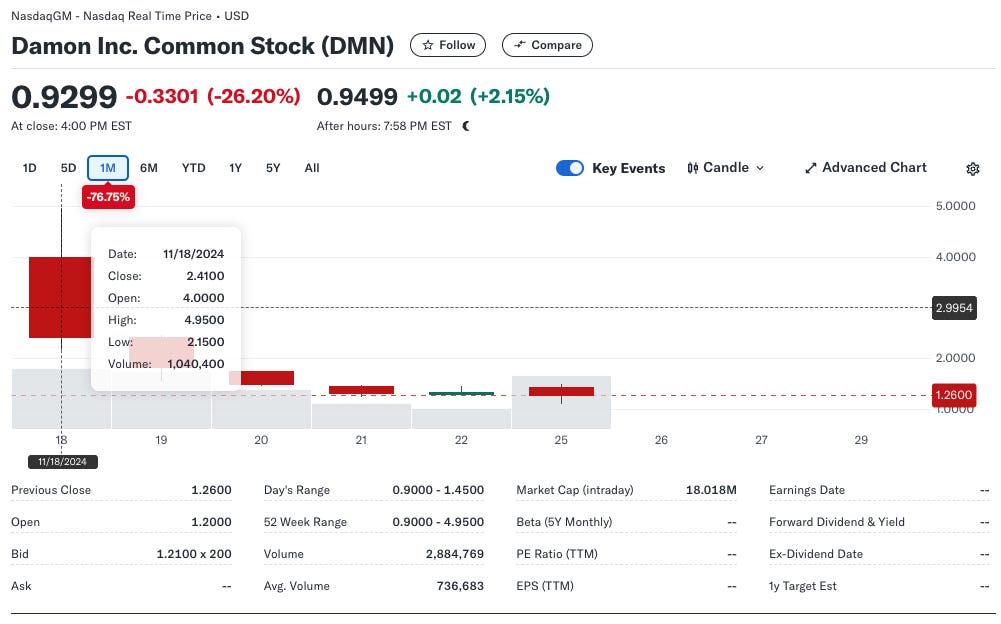

Damon started trading on the Nasdaq on November 18th. The developer of the Hypersport electric superbike has been struggling due to a lack of funding, and the listing was expected to ease the pressure. That hasn’t happened.

When Damon closed the merger with Grafiti Holdings Inc., leading to the listing on NQ, the company expected a per share price of USD 12, based on the fully diluted pro-forma equity value of the combined company at approximately USD 300m.

Instead, they started trading at USD 4.0, spiking to USD 4.95 intraday, but have fallen steadily since. DMN closed yesterday’s trading at USD 0.93. The stock has overall declined by nearly 77% from its listing price. As of yesterday, the company’s market cap stood slightly over USD 18m. Damon needs to raise more funding to produce the HyperSport and may be looking for opportunities.

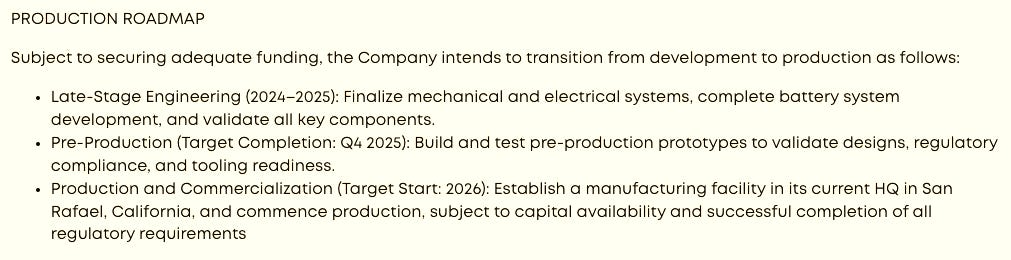

The company issued a CEO’s letter two days back, providing a business update and outlining the production roadmap. From the roadmap:

Within the same communication, the company also highlighted that they have 3000 refundable deposits with a potential revenue opportunity of approximately USD 100m. In our past experiences with other OEMs, we have seen a nearly 30 percent conversion of advanced deposits. Damon may do better as high-performance sports bikes have more passionate and serious buyers. Also, the company indicates that many of its buyers are in California, which is also a positive.

Damon also pointed out that they stand to benefit from California's Zero-Emission Motorcycle (ZEM) mandates. For every Damon motorcycle sold, they can trade carbon credits with any company that falls short on the environmental side. Tesla has done that successfully over many years, creating a multi-billion USD revenue stream.

But the Hypersport has to productionise first.

Impact

Damon needs money; the IPO has achieved little except to provide ready liquidity for a strategic investor, should one choose to enter. With the current cooling down of the enthusiasm for EVs in North America, it would need a leap of faith for an investor outside the continent.

Ola Launches

We covered Ola’s likely product launches in our previous Daily Update; the CEO had teased a new scooter/moped and a portable battery pack. Ola came good with the announcement yesterday (26-Nov-24) with an online reveal of the portable battery, the PowerPod dock that can work as a home power backup, and two scooters with two variants each.

The battery and the PowerPod system are more important to discuss here. The battery is 1.5kWh, and no chemistry or cell format has been revealed. Since Ola’s scooter batteries use NMC 2170s, they should be used in this portable battery, but we have no confirmation. Ola’s 4680 cells are a few months away, so this battery will unlikely use that.

The PowerPod is a home power backup system. Theoretically, one can remove the scooter’s battery, put it in the PowerPod dock, and use it as an electricity backup when the power from the mains goes off. Such home inverter power backup systems are very popular in India, where the power supply is often interrupted, and power cuts are frequent in smaller cities.

We say theoretically because 1.5 kWh is not much, especially after getting depleted after all day of riding.

Ola has priced the PowerPod at INR 9999 (about USD 120).

Moving onto the scooters, there are two products—the Gig range and the S1Z range. The Gig is a small moped that draws design (no dimensional specs available) inspired by Velocifero Oliver. There are two variants: the Gig has a single 1.5 kWh battery and 25 kph (L1e-A, except this does not get pedal assist) from a 250W hub motor. The range is 112km. It is targeted at the booming Indian gig worker ecosystem.

The Gig+ appears larger and has a 45kph top speed from a 1.5kW hub motor. It can take two portable batteries, though Ola says it can run on one. With a single battery, the Gig+ gets an 81km range and delivers 157km with two battery packs. We think these products have not been homologated yet, so any range claims are the company’s.

The Gig is priced at INR 39,999 (USD 475) and INR 49,999 (USD 592) for the Gig+, with a single battery.

Next, the S1Z is a conventional commuter scooter with two portable battery packs. The choice of accessories separates the two variants.

The S1Z without accessories costs INR 59,999 (USD 710), and the S1Z+, with a single battery option, costs INR 64,999 (USD 770).

The company has started taking bookings, and deliveries are promised for April.

Impact

These are the cheapest scooters in the Ola range and perhaps some of the cheapest scooters in the world. The company is tapping into a new market segment and can get high-volume growth in a segment dominated by small operators importing and assembling Chinese kits.