We normally do not comment on individual companies and their financial results. We are more like exuberant fans cheering every player from the sidelines. However, Cake’s bankruptcy has exposed the vulnerable side of the industry. Then, since last week, the world has been waking up to things going wrong at Gogoro. We are also wary of some of the biggest Indian names being a house of cards.

That means that it is possible that even well-funded start-ups could go belly-up pretty fast.

InsightEV is creating the world’s premium knowledge, intelligence, and data repository on the electric 2W and urban mobility industry. We strive to connect investors with the right start-ups and vice versa while sharing knowledge.

This is Week 21 of this newsletter. Connect with us at editor (at) insightev.com

EV start-ups wear rose-tinted glasses, and media attention provides a temporary floating sense of success when sales numbers are dismally low. Apart from large Chinese factories, no one is on a sound footing.

So, we now look at things carefully whenever the seasons shift. Vmoto has had a shift in seasons over the last two years, and recovery is not happening. The company went through some spring cleaning even as its Chinese partner, SuperSoco, folded up.

The Financials first

Vmoto’s deteriorating financials and a drop in sales numbers are why we are talking today, so let’s get them out of the way first.

2021 was pretty good for Vmoto, as sales increased consistently, and H2 2021 outperformed H1 2021. However, things started flattening towards the first half of 2022, and the second half of 2022 was the pivotal moment Vmoto started dipping. Sales have dropped from 17,601 units in H1 2022 to 7,592 in H1 2024. In the same time frame, half-yearly revenues are down from AUD 59.1m in H2 2022 to AUD 23.3m in H1 2024.

This is a sharply declining trend that has yet to reverse. Vmoto maintained operating profits until 2023 but dipped into the red in H1 2024.

That is not even the biggest concern.

Vmoto was never a major player, and its highest annual volumes have been just above 33k units. That’s 2750 units a month which has now fallen to 1250 units a month. Across 17 products and variants, that’s 75 units on average per product. Economies of scale has never been the forte.

A sharp decline from here would take it dangerously close to oblivion, and that is the prime concern.

Vmoto’s journey till here

Chinese factories are not alike - Yadea is pretty big and makes most of its money by selling under its brand in China, Indonesia, and a few other markets. In comparison, Sunra, AIMA, Luyuan, and TailG remain ‘factories’ and happily white-label for anyone.

Vmoto is a new-age Chinese brand that wants the world to take it seriously for its products, tech, and quality and ignore its Chinese origins. It is not alone—Niu, Sur Ron, Arctic Leopard, Horwin, Tromox, Talaria, and many more are in the same boat. Vmoto is just the oldest, so it has more recognition.

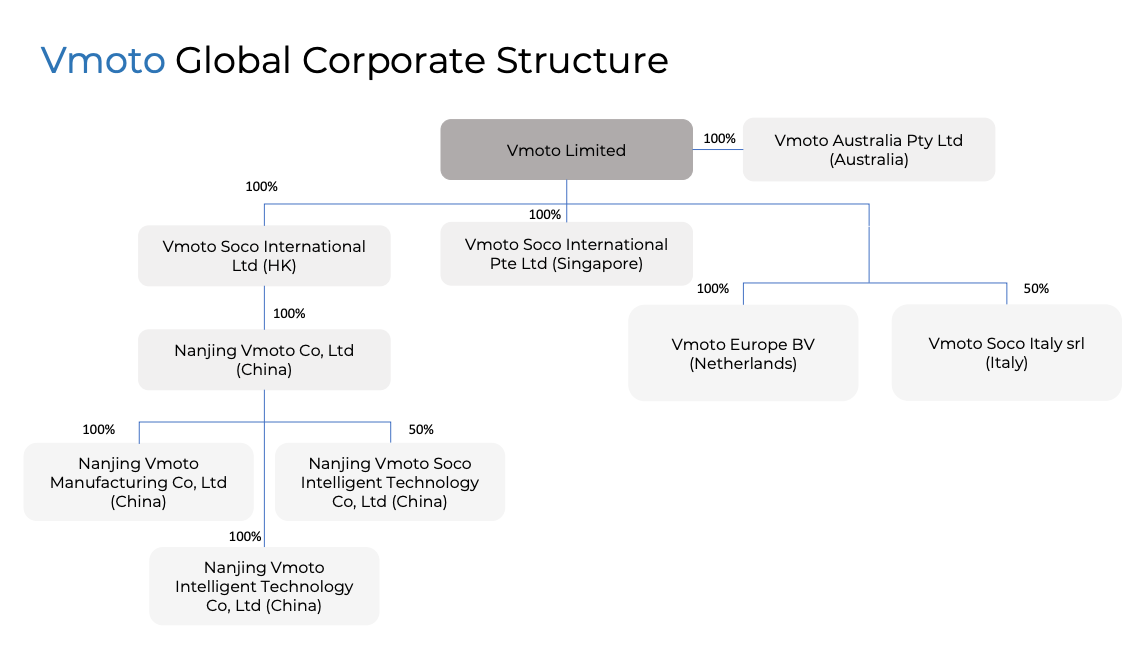

While we call Vmoto a Chinese brand, it is not entirely true. The company is based in Perth, Australia, and has a plant in Nanjing, China. For years, it had a deep relationship with Super Soco Intelligent Technology (Shanghai) Co, Ltd (SuperSoco), and the brands (Vmoto and SuperSoco) used to coexist.

The 2022-23 spring cleaning

However, in September 2023, SuperSoco filed for bankruptcy, and Vmoto had to step in to acquire the patents for various models - TS, TC, CU, CUX, TC-MAX, VS1, CPX, CU Mini, TS Street Hunter, and TC Wanderer - to continue selling them.

That’s nearly the entire range that Vmoto sells.

The cost? AUD 2.9m, or just about USD 2.0m.

Soon after, Vmoto Soco decided to rechristen itself to Vmoto.

The SuperSoco patents are not the only thing the company has splurged on recently. There has been a lot of spring cleaning. Europe is Vmoto’s primary market, and the electric two-wheeler market there is not doing well. As a result, the UK, France, and Netherlands distributors faced bankruptcy. Vmoto had to step in and acquire the distributors in France and the UK.

It also acquired 50 percent equity in its Italian distribution - Vmoto Soco Italy, spending about EUR 500k through equity.

Then, in July 2024, Vmoto also invested money (GBP 497k) in Zenion, a B2B fleet operator that leases Vmoto CPx scooters to riders operating for Uber Easts, Stuart, Deliveroo, Pizza Hut & Domino’s.

If we take a step back and look at this objectively, Vmoto invested significantly in one of its primary customers in the UK to keep them in business. This almost means that Vmoto will buy its scooters in the UK and deploy them as a rental fleet.

Vmoto has also experienced product quality-related turbulence in the European market and announced a recall of the CPx and VS1 models in Europe to inspect and replace the steering column mounts.

In addition, the company is investing in doubling its manufacturing capacity in Nanjing, and plant construction is underway.

We can see some extraordinary outflows in recent quarters, but they should have a positive impact in the mid-to-long term. As of today, what works for Vmoto is that the company has had positive cash flow until recently and was profitable until 2023. It also has a fully owned manufacturing facility in cost-competitive Nanjing, China. Thanks to the recent spring cleaning, it also owns or controls its distributors and some customers in many important markets.

So what can go wrong?

Plenty.

Vmoto has traditionally been a one-trick pony. Europe (and the UK) have been its biggest markets; sales are hard to get by outside those. It’s a brand that comes undone by its business choices of high quality and semi-premium pricing.

It cannot be a ‘Chinese factory’ player that keeps costs and prices low and volumes high. Yadea and the other factories have far greater volumes. Vmoto can never compete on price. Any technical edge that Vmoto once had has been eroded in the last couple of years as Yadea and others have started focusing on high-quality exports.

The high quality and technological edge that Vmoto enjoyed two years ago are gone. Numerous brands—Sur Ron, Talaria, Niu, Yadea, TLG, etc.—have since emerged from China and are already retailing in Europe and North America.

India is closed

Vmoto cannot sell in India because the local players are too big and can eat Vmoto pre-breakfast. As a workaround, it decided to sell the local IPs for the TC Max platform to India-based Revolt Motors. It was a one-off deal, and the local manufacturer has no continuing relationship with Vmoto. Revolt sells the motorcycle as the RV 400. It doesn’t sell much. Last we heard, Revolt was looking for buyers. For the company.

ASEAN has a limited scope

ASEAN is a mixed bag. The large markets of Indonesia and Vietnam are very cost-conscious. They are increasingly becoming EV-friendly, and Vmoto cannot compete with local players like Vinfast, Gesits, Pega, Dibao, and Anbico in these markets.

Malaysia is the fifth largest ASEAN market in terms of two-wheeler volume. Another way of looking at it is that it is the smallest market of the five significant ASEAN economies. This is where Vmoto has been trying to make a significant impact. In July 2023, the company entered into a joint venture with Ni Hsin EV Tech Sdn. Bhd. (NH EV TECH), a wholly-owned subsidiary of Malaysia-listed Ni Hsin Group Berhad (Ni Hsin) to assemble Vmoto electric scooters & motorcycles in the country. The first products were rolled out in July 2024.

Positioning itself in a corner

Vmoto has deliberately placed itself as a semi-premium brand with an eye on styling and detail. While the engineering efforts are competitive, they remain modest, driven by the company’s positioning in the commuter segment. We have observed that it is easy for the company to enter and create a new market. However, as more cost-competitive players enter, Vmoto loses market share. It doesn’t help that Vmoto’s primary focus has been on fleet operators and delivery businesses, the most cost-conscious market segments.

This happened in the UK, where the CPx was the best-selling electric scooter in 2021 and among the top ten two-wheelers by sales volume. However, enthusiasm has cooled, and the CPx is no longer in the top ten.

The European market is one of the most fragmented ones around. In 2023, we counted about 1000 brands, all fighting for just about two million two-wheelers. The biggest brand, Honda, had an 11 percent market share. Vmoto doesn’t even count as a market leader. With the hurdles to enter electric mobility at an all-time low, we expect the market to fragment even more.

Even more worrying, the enthusiasm for electric scooters has cooled down lately in UK and Europe. Sales were down all across and both Vmoto and Niu have been hit.

Unlike Niu, which went strong after fleet operators and rental companies in Europe, Vmoto has been a reluctant fleet player. Sure, the CPx is heavily deployed in fleets in the UK and Europe, but Vmoto would like the brand to be known more by retail users. Hence, the new breed of products—the On-R and Off-R—aim to ride the trend of lightweight, fun, electric motorcycles. The Stash aims at the more performance-oriented crowd.

Meanwhile, the Vmoto Fleet brand has been created to cater to fleet operators, a race that Vmoto had initially lost to Niu and then later to Chinese factory brands in Europe. The products look slightly different and customized for fleet usage, but there is a lot of similarity under the skin. The CPx and the VS1 are the same, give or take a few panels.

Focus on Design should pay….we hope.

Vmoto has always done well with the Italians. Giovanni Castiglioni, the erstwhile CEO of MV Agusta, has been a long-time European partner for Vmoto and ran the distribution operations—Vmoto Soco Italy SRL—in Italy. In 2022, Vmoto completely acquired the operations, and Castiglioni has since moved to a board position in Vmoto.

MV Agusta has made some of the best-looking motorcycles to date, and though the business has been wonky at times, running into financial difficulties now and then (like all good European brands), MV Agusta’s impact on the motorcycling world is indelible.

That’s how we expect the Castiglioni impact on Vmoto to be. The strongest impact is likely to be in the area of design, and we have seen that recently with the Stash, VMoto’s sports commuter motorcycle that it unveiled in Nov 2021. It has since gone on sale. Adrian Morton of C-Creative has styled the Stash. Importantly, Morton is the erstwhile design director of MV Agusta and created the F3 Supersport and the Brutale naked motorcycles. Hiring Morton would have been a Castiglioni influence.

Morton has also ensured that every product has V-shaped DRLs. This sort of drives a brand identity.

The other Italian influence is Ducati. Vmoto is the only scooter brand that has a Ducati-affiliated product.

Design is a steady undertone in the Vmoto story.

Vmoto's entire product range has a cohesive focus on design. Even the most basic scooters—the CUx and the CPx—have design elements that clearly make them stand out as Vmotos.

The brand also works hard to keep its products fresh and develop variants to extend the lifecycles of products like the TC and TS range of motorcycles, which have been in the market for many years.

The focus on design is deliberate. This is what separates a Vmoto from a white-labeled brand in Europe. Remember, Europe is now run over by white-label importers importing everything—from a Luyuan to Yadea.

Targeting Modularity

While the focus on design is undeniable, the products appear to be designed in isolation. The older generation products have little commonality. Vmoto is trying to change that now. Its latest portable battery is 2.7kWh and powers the CPx, CPx Explorer, Citi, CPx Pro, VS1, VS2, VS2 Citi, VS3, and TCMax models. That brings terrific modularity to the range as these are also popular models.

That would help drive profitability.

Volumes is another story altogether.

InsightEV’s upcoming Global Landscape and Prospects—Electric Two-Wheelers and Urban Mobility details Vmoto and 214 more manufacturers/startups. Please message us to request a sample.