DMN Under Pressure

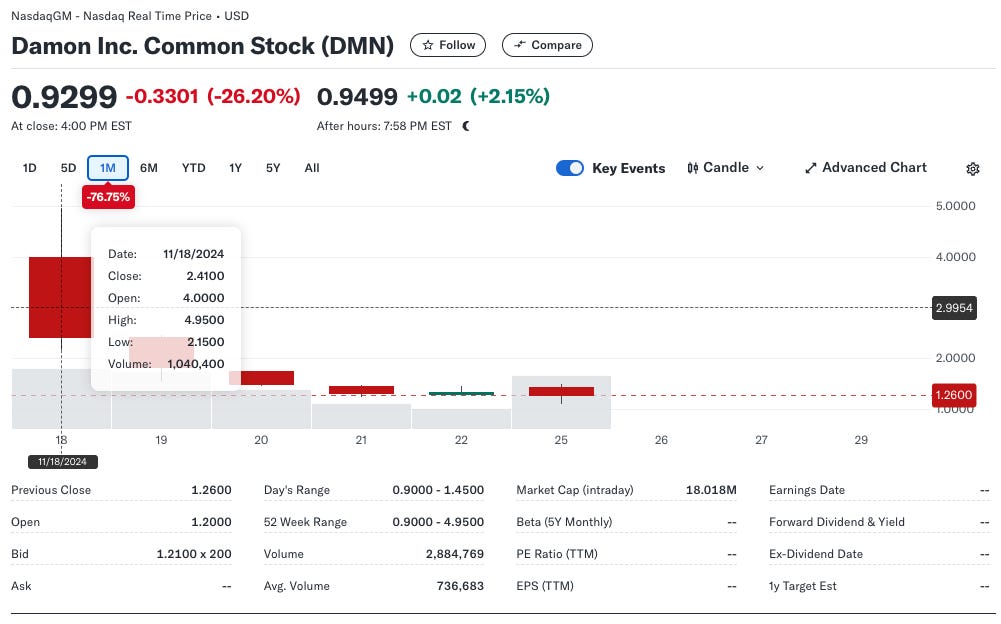

Damon started trading on the Nasdaq on November 18th with the DMN ticker. The developer of the Hypersport electric superbike has been struggling due to a lack of funding, and the listing was expected to ease the pressure. That hasn’t happened.

When Damon closed the merger with Grafiti Holdings Inc., leading to the listing on NQ, the company expected a per share price of USD 12, based on the fully diluted pro-forma equity value of the combined company at approximately USD 300m.

Instead, they started trading at USD 4.0, spiking to USD 4.95 intraday, but have fallen steadily since. DMN closed yesterday’s trading at USD 0.93. The stock has overall declined by nearly 77% from its listing price. As of yesterday, the company’s market cap stood slightly over USD 18m. Damon needs to raise more funding to produce the HyperSport and may be looking for opportunities.

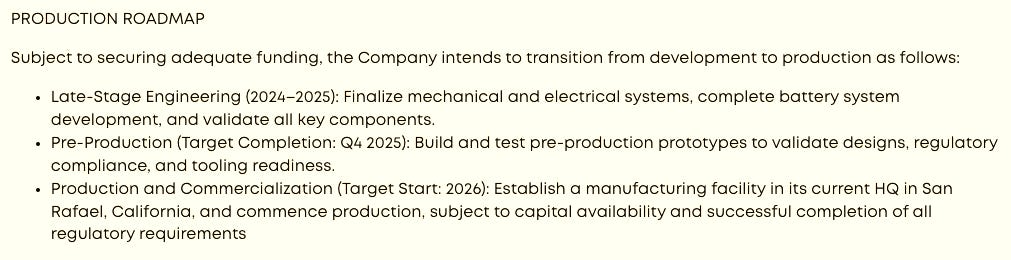

The company issued a CEO’s letter two days back, providing a business update and outlining the production roadmap. From the roadmap:

Within the same communication, the company also highlighted that they have 3000 refundable deposits with a potential revenue opportunity of approximately USD 100m. In our past experiences with other OEMs, we have seen a nearly 30 percent conversion of advanced deposits. Damon may do better as high-performance sports bikes have more passionate and serious buyers. Also, the company indicates that many of its buyers are in California, which is also a positive.

Damon also pointed out that they stand to benefit from California’s Zero-Emission Motorcycle (ZEM) mandates. For every Damon motorcycle sold, they can trade carbon credits with any company that falls short on the environmental side. Tesla has done that successfully over many years, creating a multi-billion USD revenue stream.

But the Hypersport has to productionise first.

Impact

Damon needs money; the IPO has achieved little except to provide ready liquidity for a strategic investor, should one choose to enter. With the current cooling down of the enthusiasm for EVs in North America, it would need a leap of faith for an investor outside the continent.