Late last week, Gogoro’s Chairman and CEO, Horace Luke, resigned amid falling margins and allegations of fraud.

Ruentex Group’s general counsel, Tamon Tseng, replaced Luke as chairman. There is more to what meets the eye—Ruentex is Gogoro’s biggest stakeholder and clearly wants to get things under control.

The biggest shareholder putting their general counsel on top of the board indicates that all is far from well behind the scenes and there is likely a serious fraud investigation going on.

Further, Gogoro appointed Henry Chiang as the interim CEO. Chiang has served as the company’s general manager since 2022 and the head of its GoShare team.

Questionable Business Model

A few weeks back, we wrote about Gogoro and questioned its entire business model. The battery-swapping model has received much media attention, making Gogoro the electric scooter darling of the Internet. The business model puts Gogoro as an energy company running battery swap networks.

Scooters were secondary, a by-product of the system.

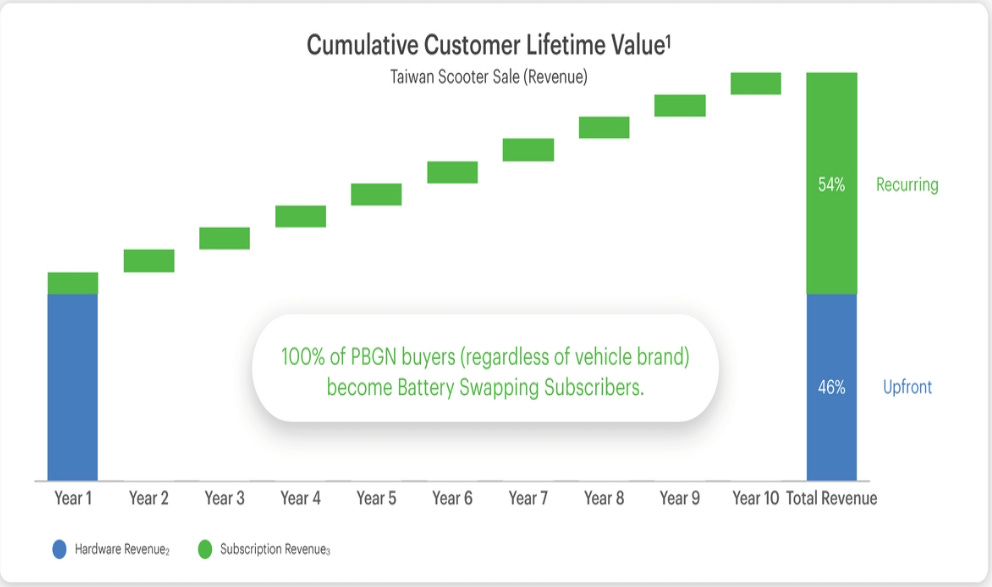

Gogoro is so confident in its swapping network and capabilities that it offers the same network, batteries, and motors to multiple rivals in the Taiwan market.

This is quite surprising since we have always found Gogoro mid-drive motor scooters very likable, a generation ahead, and highly over-specced compared to scooters of Chinese or Indian origin.

So why would a company loan the same motor and battery to other brands, including Yamaha and Yadea, which are much bigger in size and scale?

Never made any sense.

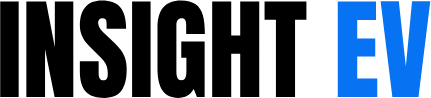

Sharing the most important part of your business with rivals may not be a good idea, giving them your edge for a small fee. Gogoro’s swapping network revenues have been growing healthy, but the actual scooter sales have declined. It doesn’t help that Gogoro is one of the more expensive brands of all the above.

The problem with such a business model is that vehicle sales are secondary. However, it is the vehicles that define a company. If the trend continues, designing and manufacturing scooters may become unviable. That eventually diminishes the brand and erodes the barriers to entry in a market segment notoriously low on entry barriers.

To give credit, Gogoro’s sharing the network with the most important brands in the Taiwan market insulates it from competition. At the same time, the company sacrifices its scooter margins and volumes to safeguard its network.

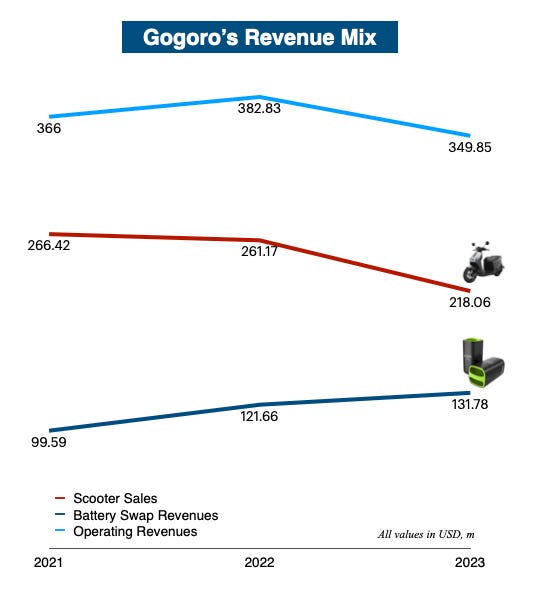

The company wants investors to examine its recurring revenue model, which is the kind of model data providers and consulting companies would love to have. Every automotive manufacturer wants a certain percentage of their revenues from subscription services.

No one would do that at the expense of retail sales.

For argument’s sake, we can also point out that Honda is doing the same under Gachaco in Japan and is also trying to do so in India. But it is not the same – Gogoro helped rivals get into the electric market in Taiwan. In India, Honda is wooing existing E2W and E3W players. In Japan, Honda formed Gachaco as a company with smaller equity partnerships from the others who plan to use the Honda MPPs. The biggest equity partner is ENEOS, which effectively bankrolls real estate and network rollouts.

Objectively, Gogoro is destroying one hand to feed the other while Honda is just building initial scale for its MPP swapping network.

Limited to Taiwan

Gogoro is well entrenched in Taiwan but has little going for it in other geographies. The company wants to be global, but the battery-swapping model is terribly expensive.

As the above graphic indicates, Gogoro is in Taiwan and has a presence in multiple other South and Southeast Asian countries. Sure, there is a presence, but that presence is dismally low as of today.

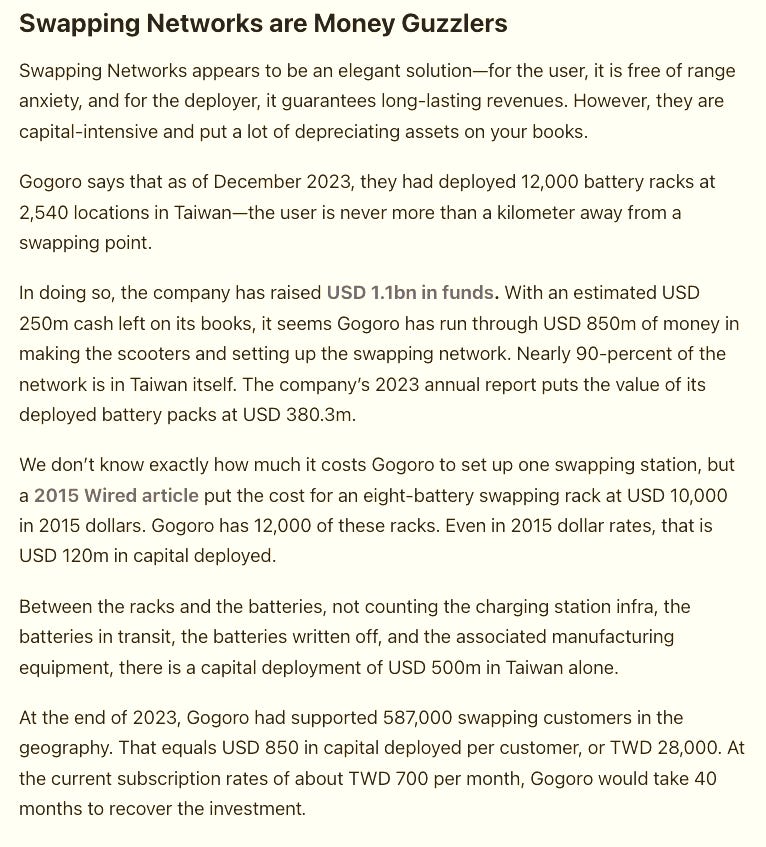

Battery-swapping networks are notoriously expensive to set up. We wrote this below a few weeks back:

The above indicates the kind of money-guzzling business that Gogoro is in. If they could burn through USD 1.1 billion in a small geography like Taiwan, guess what would happen if they wanted to roll out across 25 cities in Europe, 50 cities in North America, or across India?

But this is Gogoro, and they do well in raising funds. Within the last year, they have raised USD 75m from two investors. In June 2024, Castrol invested USD 25m in the company, and in the same month, Gold Sino Assets invested USD 50m in the company.

Cheaper Scooters the answer?

After burning its expensive scooters by sharing the tech with others, Gogoro has been addressing some concerns by adding cheaper, likable scooters. We have always been big fans of their industrial design capabilities, and the Crossover and Jego are pretty nice-looking scooters.

Unlike the Pulse, S2, and Sport range of scooters, which use liquid-cooled, mid-drive motors, the Viva, Jego, and Crossover use hub motors. The Jego is one of the cheapest scooters in the Taiwan market, made even cheaper because of government subsidies. That is in the eye of the storm.

As per exchange filings dated 13-Sept-2024, Gogoro has admitted that

“the Company has identified certain irregularities in supply chain which caused the Company to inadvertently incorporate certain imported components in some of its vehicles. The Company has reported the irregularities in supply chain to the local authorities and is fully cooperating with the local authorities in their investigations, while also continuing with its internal investigations.”

It is no longer an allegation; it is an admission.

We can only speculate that the allegations have been around the hub motor used in the Viva, Jego and Crossover models.

Subsidies for electric vehicles linked to local sourcing are fairly common globally. It is no secret that the Chinese ecosystem operates at a different scale and a much lower price. The global electric vehicle manufacturing ecosystem is developing, and every relevant market wants to ring-fence itself from imports, especially from China.

At the same time, every country wants to develop its electric supply-chain ecosystem. So, they link electric vehicle subsidies to the localization of critical components – motors, battery packs, electronics, etc. Taiwan did the same. India’s FAME-2 subsidies were along the same line. Indonesia has also adopted a similar policy.

Corporations repeatedly try to cheat, take shortcuts, and get caught. This happened in India when a number of players were penalized. This represented half the industry and changed the order completely.

Now, it is happening with Gogoro.

The share price collapse

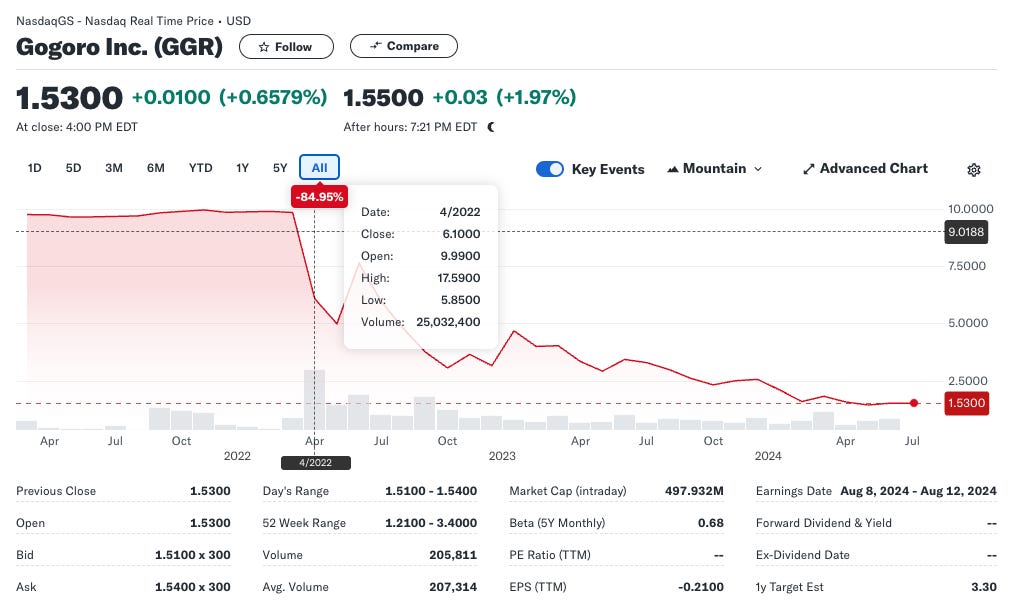

When we wrote our last piece on Gogoro in mid-July, we pointed out that the company had lost 85 percent of its market cap since listing on Nasdaq in April 2022. The Gogoro stock was trading at USD 1.53, and the market cap was just shy of USD 500m.

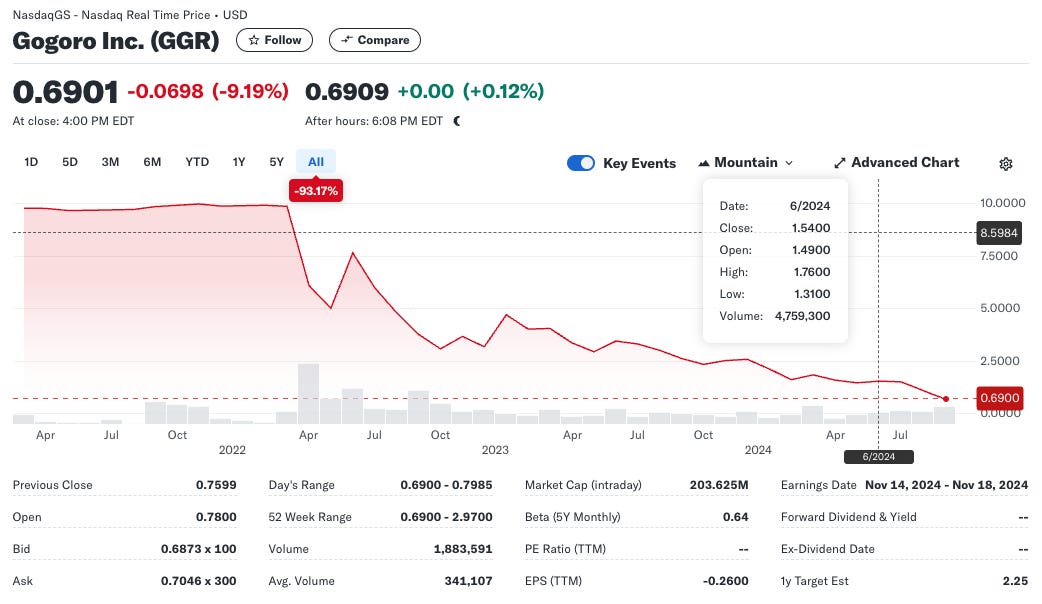

Things have taken another deep dive since then. The last two quarters have been devastating financially for Gogoro. In Q1 2024, the company reported a net loss of USD 13.1m. In Q2, the net loss increased to USD 20.1m.

As of yesterday, Gogoro closed at USD 0.6901, the lowest ever. This is a 55 percent drop from mid-July prices. Overall, this is a capital erosion of 93 percent since Gogoro went public in April 2022.

This begs the question – is the brand now bigger than the company?