Ola Electric Loses Market Share and Leadership

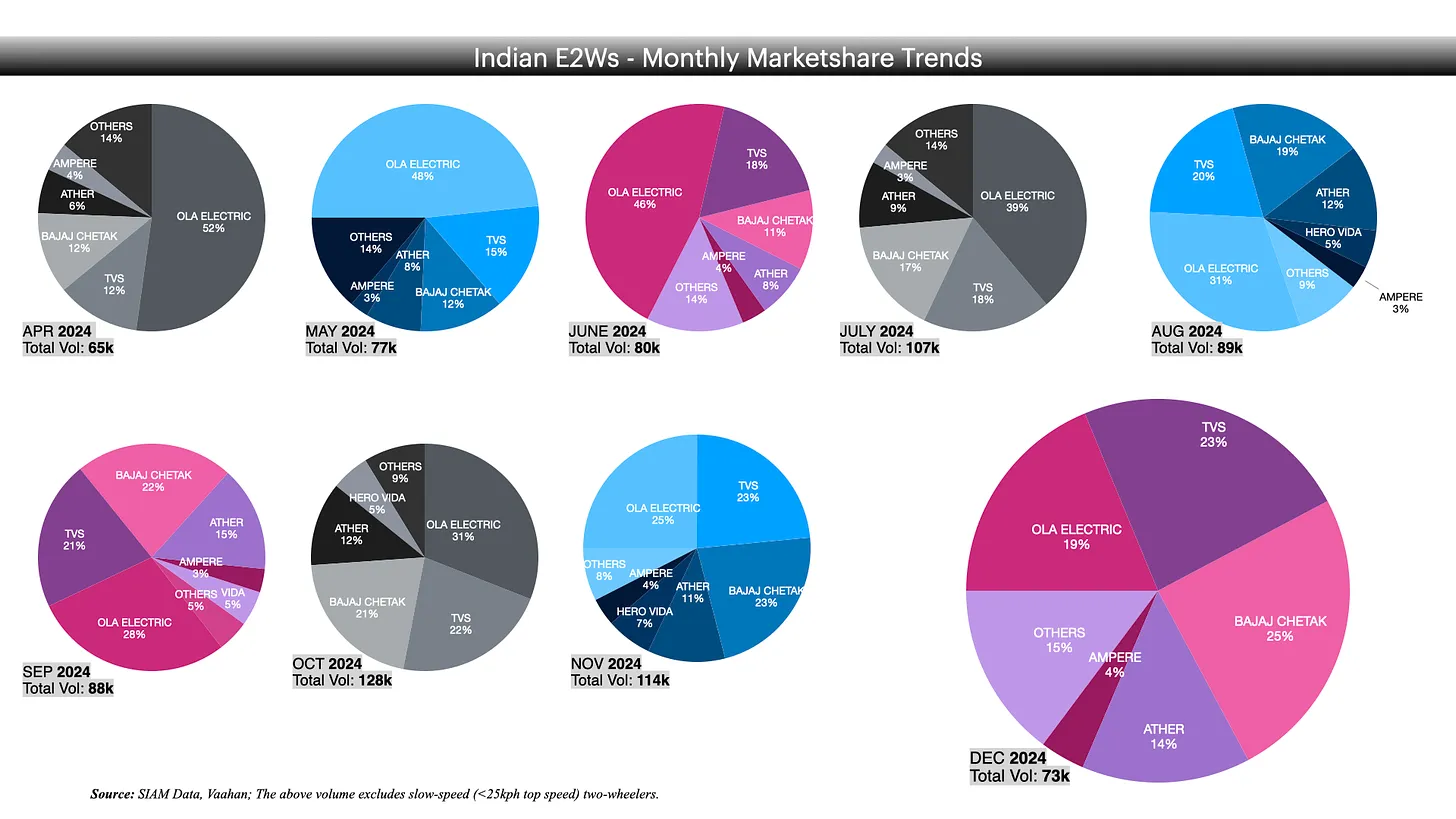

December was not good for India-based Ola Electric, as it lost the crown of the country’s leading two-wheeler manufacturer. The Indian market for electric scooters hovers around 100,000 units a month, though December was slow, with overall registrations of around 73,500 units.

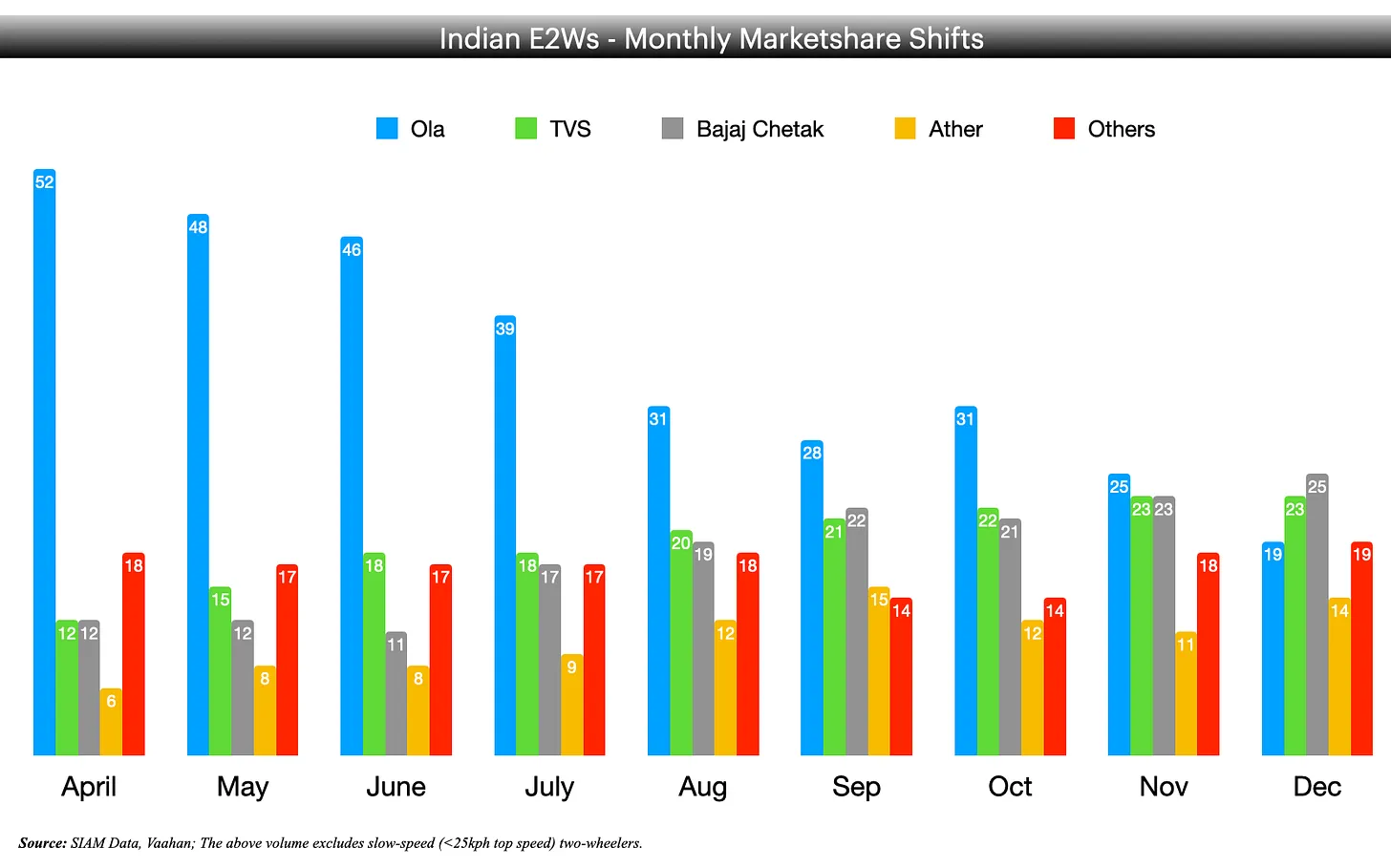

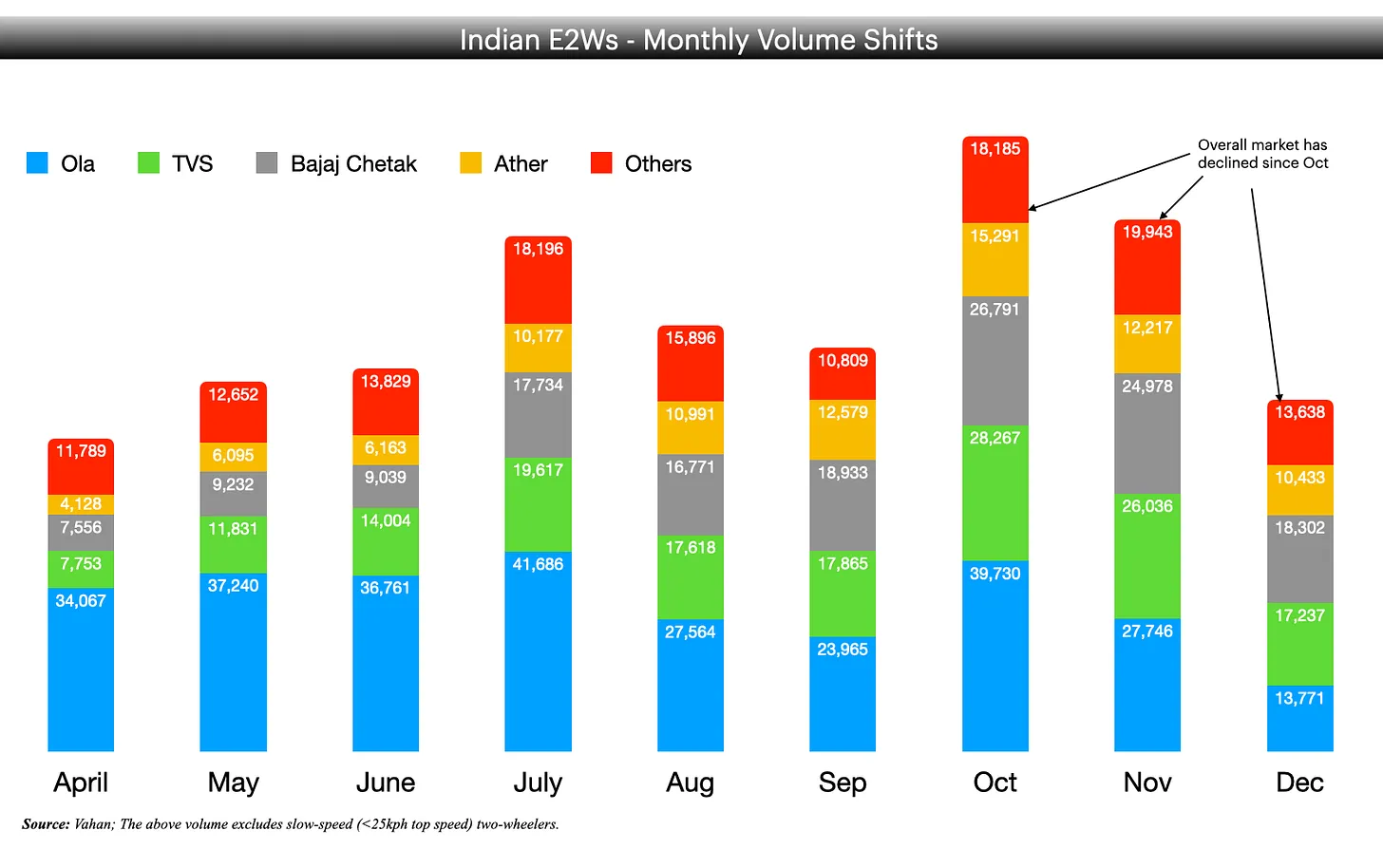

Since April 2024, when we started tracking the Indian market, the pecking order has repeatedly changed, though Ola’s share loss has been steady.

A better chart to understand the shift would be the one below. The blue column is Ola, and it has been declining steadily. The grey and green columns are Bajaj Chetak and TVS, respectively, and both have steadily increased. Even Ather Energy (orange column) has managed steady growth in market share since July.

The Indian market has also experienced a dip in the last two months, and December volumes were the lowest monthly volumes in the second half of the year. In fact, every major participant has seen a dip in volumes over the last two months. However, Ola’s volumes absolutely tanked, declining by more than 65% within the two-month period.

Ola believes it can improve things by increasing its sales network and, in an audacious move, opened 3200 new experience centers on 25th December. This, in addition to the existing 800 centers, takes Ola’s customer contact points to around 4,000. Market leader Bajaj Auto has about 4100 dealerships.

Impact

Ola has bigger worries than volumes. The loss in market share is because Bajaj Auto and TVS Motor are steadily improving their products and pricing and gaining volumes as a result. At the same time, Ola has earned a bad reputation for its service issues and product niggles. A high-volume developing market like India is driven by word of mouth rather than social media advertising. It seems that the negative word-of-mouth has caught up with Ola’s sales, and the slump is likely to be a long-term one.

No Tax Breaks for Electric Motorcycles in The Netherlands

The Dutch are no longer incentivising E2W purchases. Just a few days before the close of 2024, the Netherlands government announced in Staatscourant that the tax benefits for electric two-wheelers would no longer apply.

The removal of subsidies means that electric motorcycle prices may go up by as much as EUR 4500, making them an unviable purchase.

The Netherlands is not the biggest two-wheeler market in Europe. It’s not even the top ten in Europe. However, the small market, especially the city of Amsterdam, has been at the forefront of electric two-wheelers in Europe thanks to scooter-sharing services with operators like Check, Felyx, and GO Sharing. At one time, Amsterdam allowed slow-speed mopeds to use bicycle lanes.