Electric mobility is expensive because we are at the start of the journey. Scaling up takes time. At the same time, we are competing against a mature technology that has had more than a century to streamline its efforts, optimise costs, and drive up scale.

Understandably, electric vehicles have high BoM costs, and it is difficult to make any real money in the business right now. Staying Gross Margin positive is the clear and present target for now, while everyone works on improving process efficiencies to improve the numbers at the bottom of the balance sheet.

Gross, EBITDA, and Net Margins: Stages of Separation

In most cases, manufacturers (E2W startups) operate in the Gross Margin positive space. However, most key participants are operating at high double-digit negative EBITDA margins. Getting the EBITDA into positive territory is the next peak to scale before the industry has a go at Net Profits.

Only when that peak is conquered does the industry become bona fide, one that provides a positive Return on Capital Employed (RoCE).

A lot of money is sitting anxiously, hoping the industry climbs the net profit cliff someday.

During the peak of private money in the E2W business, startups globally raised more than USD 6.2 billion in funding.

That’s significant capital deployed, all with the aim of pulling the rug from under the feet of the ICE incumbents in the lucrative two-wheeler business.

Except that taking market share is one thing. Making money while doing so is another.

Going Electric: The Natural Handicap

The ICE engine has evolved over nearly 140 years to where it stands today. The same is true of the two-wheeler itself. Today, the world makes many millions of them, and the global supplier community has mastered and fine-tuned the art of making engines, frames (especially welded steel tubes), transmissions, and other components that go into making an ICE two-wheeler.

Across the world, we produced an estimated 52 million ICE two-wheelers last year. Significant geographies like India, China, and Indonesia produce millions of two-wheelers, and the local supply industry has very large volumes, giving them scale benefits. This has reached an efficiency level where the best-selling two-wheelers (sub 125cc) in the biggest two-wheeler geographies have Bill of Materials (BoM) costs of less than USD 500.

There is no way a similarly specced, same-purpose, commuter scooter or motorcycle with a battery and a motor can match these ruthless BoM costs. Electric is born with this disadvantage, and it would take many more years of an ideal scenario where ICE two-wheelers suffer a spike in BoM costs due to adding electronics, giving money to BOSCH (more stringent emission and safety norms), and more, while E2Ws somehow (miraculously?) hold their BoM costs.

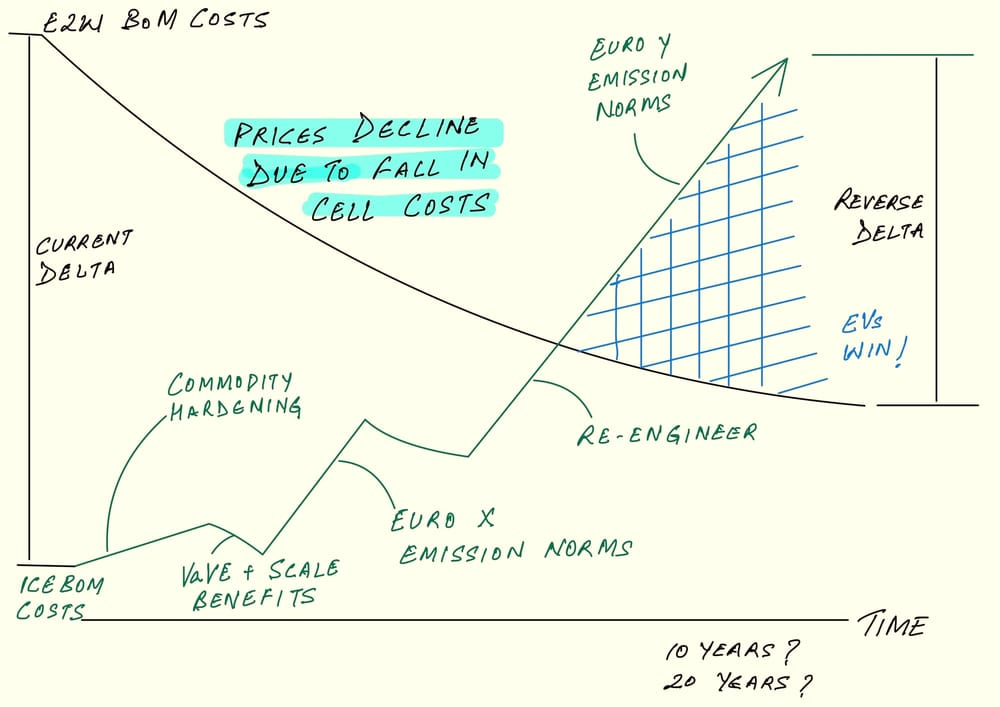

I doodled on my iPad a Likely Dream Scenario

The line at the bottom (in green) represents mainstream ICE BoM costs. The one at the top (in black) represents the current E2W BoM costs. A large delta exists, a delta in favour of the ICE industry.

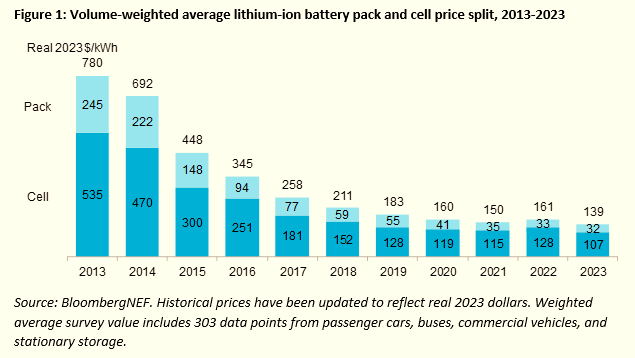

The eternal E2W optimist expects the black line to fall over time thanks largely to declining cell prices. That has been the trend over the last decade, and everyone expects it to continue, as this chart from BloombergNEF indicates:

This is a demand-and-supply situation. China has installed huge capacity, and the rest of the world is busy adding to it. The trend is likely to continue in the short term, and that’s great for the industry. Would it continue for ten years? Anybody’s guess. Nowadays, the world has too many black swans for forecasts to have any accuracy.

Meanwhile, the green line would have many things to worry about. There is always the ubiquitous commodity hardening, something that the automotive industry grapples with continuously. Now, commodity hardening should impact the E2W industry more as it uses more metals, more exotic stuff, but somehow long-term planners side-step the issue.

For the ICE two-wheeler industry, any moderate commodity price increase would be balanced by scale, finding new efficiencies, and value engineering.

However, the next big peg up in BoM costs for the ICE industry would come from a move to higher emission norms. Mature markets like India are already on Euro VI equivalent emission norms. A move to even higher levels would add to the BoM costs.

Over the long term, ICE BoM costs should naturally go up.

The caveat is that so should E2W BoM costs, but the global consensus analysis is clouded by falling cell prices.

Moreover, the analysis is for the far-off future. For now, the industry is grappling with high BoM costs, supply chain issues, a limited market, and private money that is suddenly not there.

The Quest for Profitability

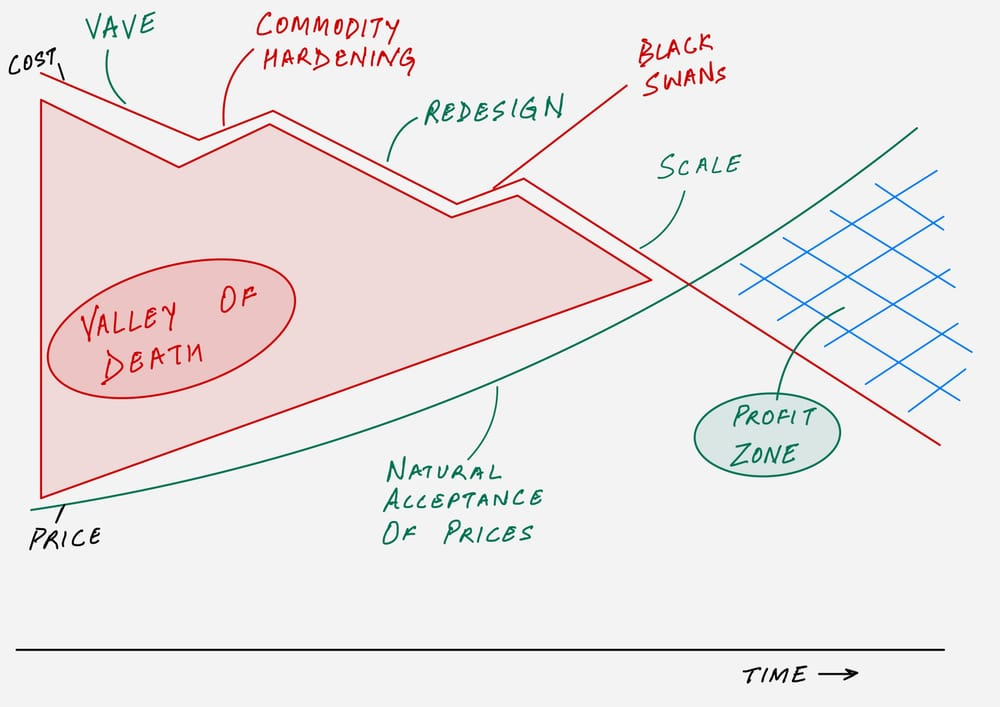

This second doodle on my iPad explains the industry situation. We are currently in the “Valley of Death,” all of us, irrespective of geography. The Cost is much higher than the Price.

The red line on top represents cost, specifically the BoM cost. The green curve at the bottom represents the price that the customer has to pay. It is climbing upwards as, over time, there is a natural acceptance of high prices.

The target is that the red line has to come down. The industry tries to achieve that through VAVE exercises, simplifying design (also called redesign), and eventually getting scale to drive efficiencies.

However, over the last five years, the industry has also weathered multiple black swan events: a cell supply crisis, then a semiconductor crisis, and now a rare earth supply crunch because of the China ban, which got lifted just two days ago. Geopolitics is not something that we can control, but the trend recently has been that crude prices, which are more prone to random geopolitical events, have become resilient to them.

In comparison, a sudden vanishing of semiconductors or rare earths is an event that the world has not planned for.

Remember, here the Cost is not just the BoM cost, as we are beyond seeking Gross Margins only. This cost includes all the line items that show up later, everything that is needed to manufacture and sell the vehicles.

The challenge is that years of accumulated management acumen have already made the line items below the BoM cost as efficient as they are practically possible. Reducing further would impact the secondary functions beyond repair.

So the best attack would be on the BoM costs, and that’s what the industry has been doing.

But that is easy to say and difficult to do. The ICE two-wheeler has decades of experience, and the industry has mastered cost optimisation over time to the point that Indian manufacturers like Bajaj Auto manage to wring out more than 17% in net margins.

In comparison, we are still on the first generation of electric two-wheelers. The industry is still figuring out vehicle design. Optimisation comes much later.

How to Reduce BoM Costs Without Breaking the Product?

Take a BMW and hand it over to the Japanese, and I am sure they can extract a few percentage points in cost optimisation. The BMW would still be a BMW, though it would likely be more dependable now. Hand over the same car to the Koreans and they can extract some more in cost optimisation without changing the car much.

But eventually, there is a limit to what optimisation can do. You cannot beat down a BMW to the cost level of a Suzuki, however much you optimise. That, perhaps, is the holy grail for the E2W industry as well. Optimise things beyond a limit and you would cross the fine line into unacceptable.

The battery is still 35-40% of the BoM costs for a commuter scooter, and we have already baked in falling cell prices into our reduction program.

But what is beyond that? Where else can we shave off things?

For Every Action, There May Be an Adverse Reaction

The industry has to walk a fine line between BoM cost reduction and compromising on product design/engineering. Often, in the guise of VAVE, it is easy to compromise on component quality.

What a VAVE exercise often means is to go through the entire vehicle with a comb. There are no big leg-downs in BoM costs, but several small saves that add up to a big win. However, the nature of the beast means that for every component that we may want to redesign or integrate with another component, something else would get impacted.

Take small wins like brake pads. A lower grade would shave off a dollar or two from the BoM costs. That’s no mean feat and looks great on the balance sheet if you ship 20,000 scooters a month. It offsets the private jet charter costs for the CEO. But cheap brake pads mean the customer is back in the garage within four-digit kilometres, and that’s not great for the customer or the brand. The long-term repercussions are unforgivable.

The same goes for reducing the grade of the tires, the wheels, and the plastics. They may not change paper specs, but they change the product.

One of the popular ways forward is to try reducing the number of chipboards. There are at least three on any self-respecting vehicle: a Battery Management System (BMS), a Motor Controller (MCU), and a Vehicle Control Unit (VCU). None of the OEMs manufactures the chipboards themselves, though some do design them. Manufacturing is capital-intensive and is sourced from suppliers like Foxconn, Pegatron, etc. In a normal architecture, the BMS sits next to the battery, the MCU sits next to the motor, and the VCU sits somewhere else. Tying everything together is the wiring harness.

Now, if a couple of these controllers were to be co-located on one chipboard, it would likely save manufacturing costs and also shave off some costs from the wiring harness. That sounds good, but it is a double-edged sword. Any failure, and the industry suffers from rampant electronics failures, and you end up replacing what is now effectively a more expensive chipboard. Warranty costs can escalate fast.

The same goes for colocating the MCU with the motor. Any problem with the electronics and the repair costs can be huge. That has been the sore point of hub motors universally.

Underestimating Commodity Hardening

At times, we underestimate commodity hardening and the impact it may have. Any vehicle is made of a combination of processed metals and plastics. While ICE vehicles use mostly steel and aluminium, E2Ws are more exposed as they have heavy use of copper and rare earth metals. Their prices are increasingly volatile, as global usage has been increasing.

For illustration, here is the monthly chart for Copper futures. Between 2020 and 2025, the prices have gone up by 200%.

We had a similar spike in Aluminum between 2020 and 2022 when prices spiked up by 140%.

Then here are the Nickel futures, an integral element of all NCM chemistry batteries. Between 2020 and 2022, prices spiked by 300%.

However, in sharp contrast is steel, the most important constituent of ICE two-wheelers. It has declined by 60% since 2022 and is still in a declining trend.

As a direct implication, commodity hardening may not be an immediate issue for ICE two-wheelers but is very much one for electric two-wheelers, though the charts indicate price volatility more than long-term commodity inflation.

Profits Don’t Deceive Everyone

It’s not that everyone is making losses in the industry. The industry can be broadly segregated into two parts: The first are the Chinese factories, and then comes everyone else across the world.

We touched on this a few weeks back; the Chinese factories have no problems in making profits.

Which also makes it an ironic situation – Marketing 101 taught us that the brand is sacrosanct and that’s what would make you profits. Except, the Chinese have figured out how to make profits by being factories. Further, they collaborate and coexist, more than compete. As an ecosystem, this creates even bigger scale. More motors manufactured, more cells produced, more of everything, more E2W components than everyone else in the world, combined.

And that’s what matters.