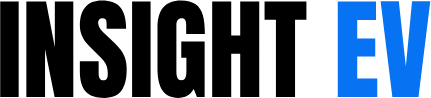

Q1 2025 was when LiveWire hit its lowest quarterly unit sales, selling only 33 motorcycles. This, with three models in the showroom and the entire financial backing of Harley-Davidson, is worrying on so many levels.

First, The Numbers

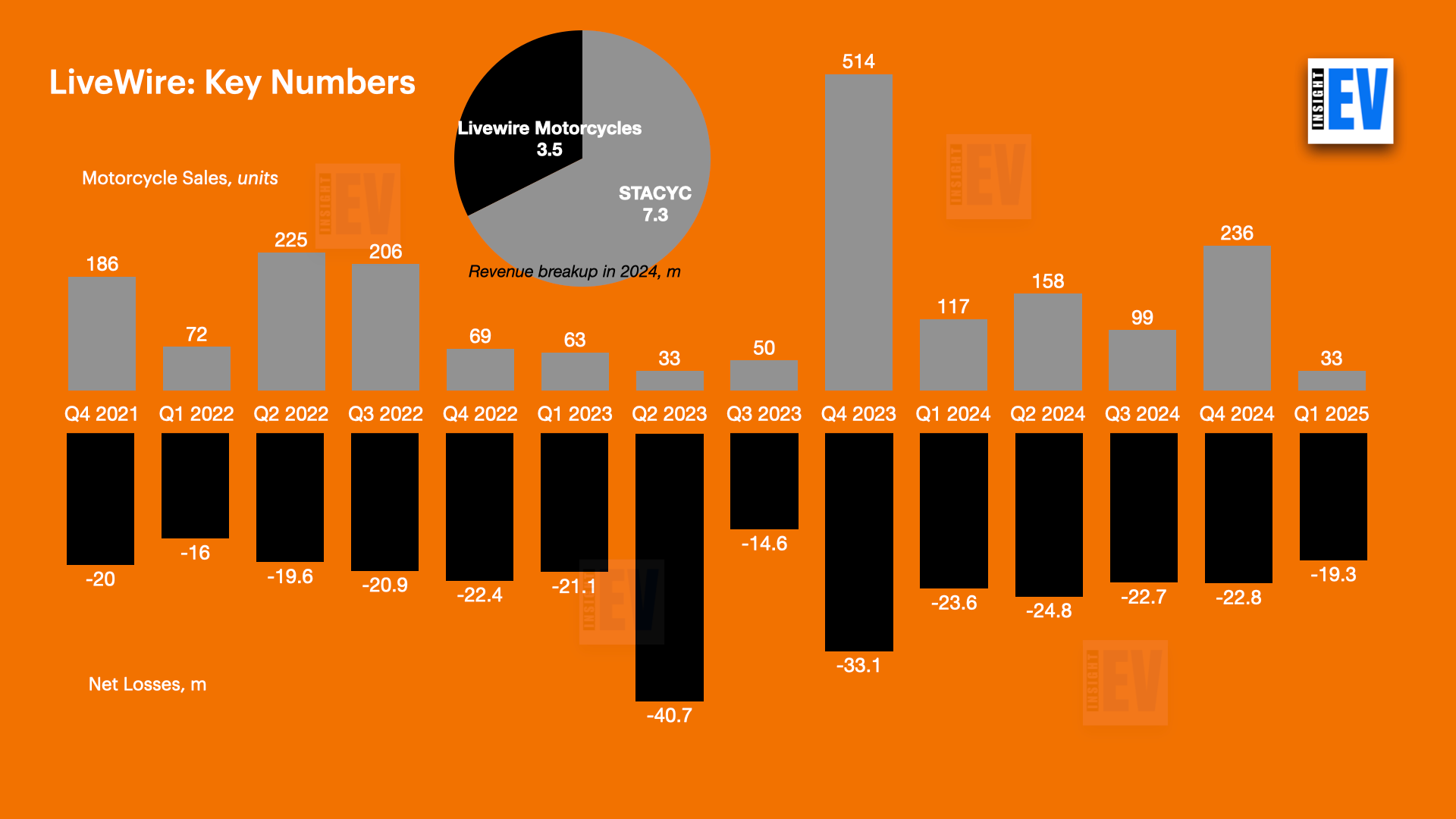

In Q1 2025, LiveWire sold 33 motorcycles and 1,970 electric balance bikes under the STACYC brand. In doing so, LiveWire earned revenues of USD 0.4 million, indicating a transaction price of slightly more than USD 12,000 per motorcycle. It also earned USD 2.3m in revenues from STACYC, indicating an estimated transaction price of less than USD 1,200 per unit.

The operating loss from motorcycle operations was USD 19.4 million, while STACYC incurred an operating loss of USD 1.3 million.

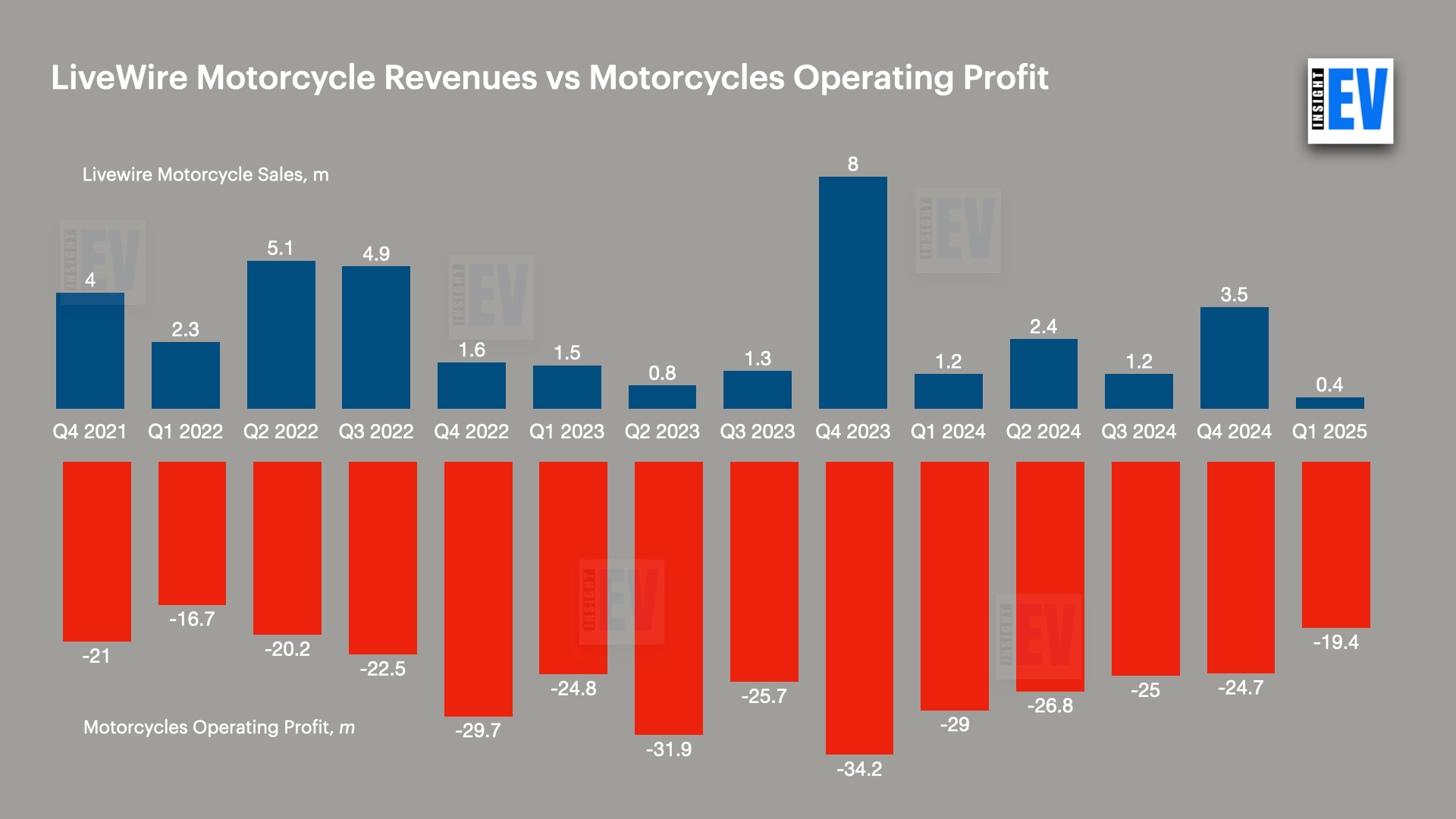

STACYC: A Business Destroyed

It was not long ago that STACYC, a company that H-D acquired in March 2019, was making profits on healthy sales.

However, since reaching a peak of USD 9.8 million in sales and USD 1.5 million in operating profit in Q3 2022, both numbers have steadily declined to their current levels. This was the fifth consecutive quarter of operating loss for the STACYC business.

The future may be tough for the business as the US market for electric balance bikes is getting extremely crowded.

Improvement in Net Loss

While the operating loss has reduced to only USD 19.4 million, the net loss has reduced to USD 19.3m from USD 22.8m in the previous quarter. This has been driven mostly by the cost-saving measures taken last year, including moving the entire team from Silicon Valley to Milwaukee, letting go of some talent, and reducing the overall cost of operations.

Impact

LiveWire currently has three models in the showroom and could manage only 33 unit sales in the quarter. This is worrying at multiple levels. First, it indicates that there are hardly any takers for expensive electric motorcycles in North America. As an extension, the culture change that Harley was counting on when it started LiveWire has not happened yet. America’s climate weekend warriors are deciding to stay away when it comes to putting money where their mouth is.

This is despite many states offering incentives on electric vehicle purchases that also apply to electric motorcycles.

With Harley busy with its own dwindling performance and boardroom battles, LiveWire has to tread carefully and move fast on new products. However, the current declared pipeline does not give us confidence. Livewire needs to go to smaller format vehicles, target a selling price of sub-USD 5000 to improve volumes.