Gogoro announced its quarterly results yesterday, and revenues continued to slide. The slide was driven by a steep fall in scooter sales that marginal growth in battery swapping revenues could not compensate for.

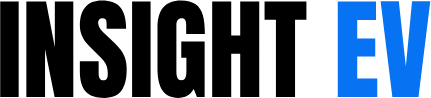

In Q1 2025, Gogoro’s gross revenues were USD 63.62 million, down 8.7% year over year from USD 69.7 million in Q1 2024. On a rolling year basis, Gogoro has recorded revenues of USD 304.42 million in the last four quarters, a decline of 10.53% from revenues of USD 340.24 million in the previous four quarters.

The slide in revenues has been a near-consistent trend post-COVID and has not yet started correcting.

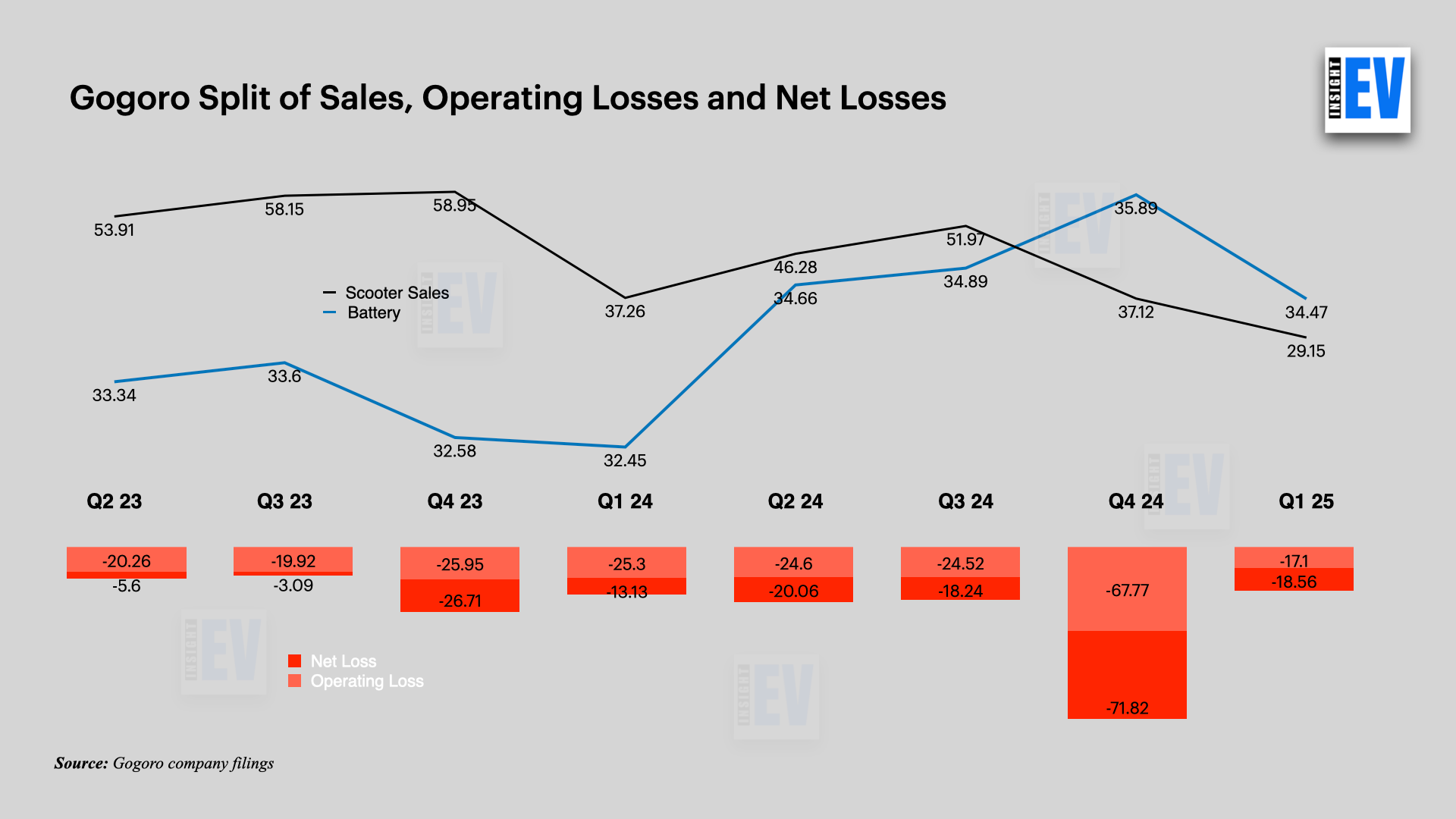

Gogoro divides its revenues into two segments: battery swapping revenues and scooter sales revenues. While scooter sales revenues have been dropping, battery swapping revenues are improving as more subscribers accumulate in the network every month. Gogoro also offers its network and hardware to at least seven other brands in the Taiwan market.

However, the increasing swapping revenues are not yet strong enough to offset the fall in scooter sales revenues.

In the quarter, while battery swapping revenues improved by 6.22%, scooter revenues collapsed by 21.8%.

The only positive metrics in the quarter were the Operating Loss, which improved from USD 25.3 million to USD 17.1 million. Meanwhile, Net Loss deteriorated further to USD 18.56 million. It was USD 13.1 million a year back.

Deteriorating Cash Situation

Since going public in 2022, Gogoro has not made a profit till now. The company, since its inception, has managed to create an enduring brand that was once acknowledged as a technology leader and innovator with its battery swapping network. On the back of the innovation and the early mover advantage, Gogoro has raised huge capital that has allowed it the freedom to execute its business strategy.

However, we had questioned Gogoro’s business strategy of sharing battery swapping and hardware with competitors.

With continuing losses, the cash situation has also been deteriorating. In this quarter, Gogoro had an operating cash outflow of USD 8.9 million. This has reduced the cash position of Gogoro to USD 93.3 million, down significantly from USD 132.51 million a year back.