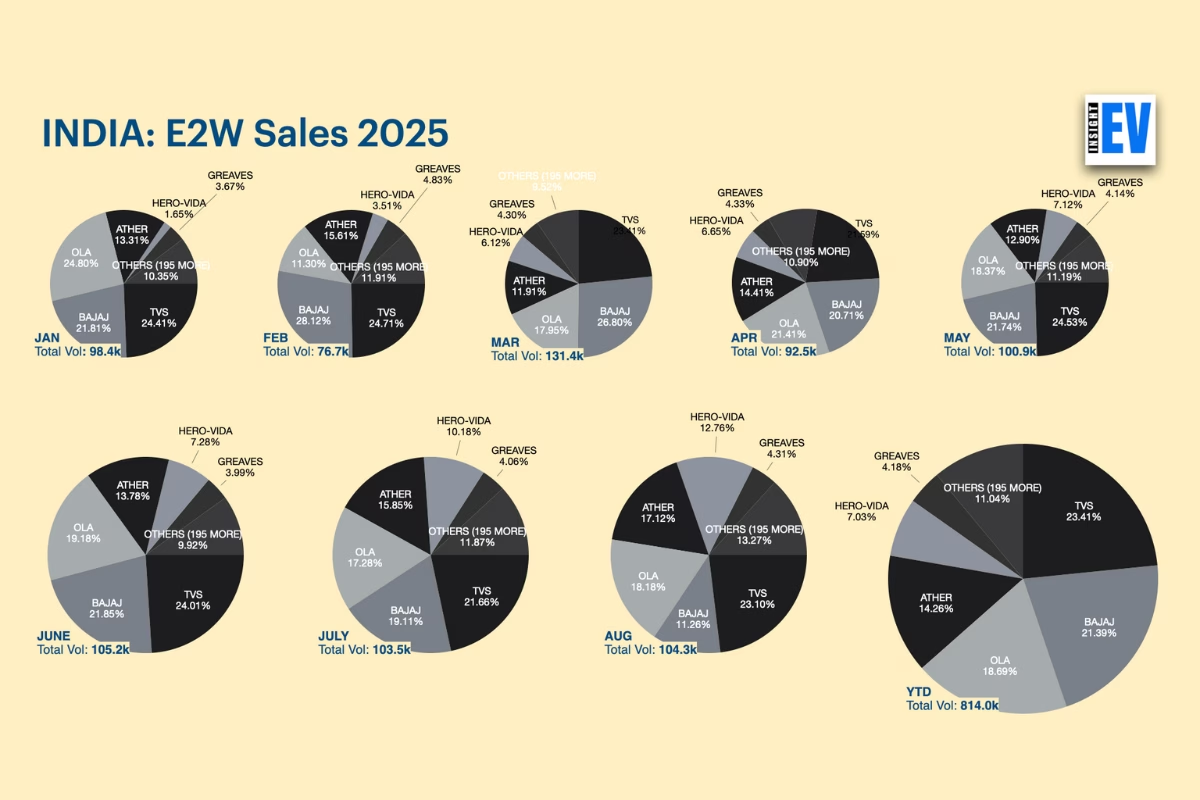

The Indian industry managed to sell 104,373 units in August 2025. This is a near 1,000 unit improvement over July, not significant at the overall level.

However, the numbers have to be seen in the light of the ongoing rare earth crisis, which meant that some motor suppliers and their OEMs did not have magnets to manufacture motors.

The worst impacted was Bajaj, which saw its sales numbers come to a standstill this month. The company’s sales decreased from 19,772 units to 11,756 units, a 40.5% decline.

Was this an aberration?

Definitely.

Things should be back to normal now, considering that the Indian and Chinese governments have reached some understanding.

However, the crisis at the supply chain level may still need a few more days to reach normal levels.

The rare earth crisis meant that the pecking order changed dramatically this month. TVS remained the market leader, registering 24,109 units, a healthy 7.5% month-on-month growth.

Ola jumped to second with the registration of 18,972 units, a 6.1% jump from last month. Ola makes its own motors, so it is likely they had the inventory to sustain themselves when the supply chain crisis hit.

Ather was in the third position, and this is a rather good story. The company managed to register 17,871 units, a nearly 9% improvement over July 2025. Ather has been on a streak, and looking at the data for the last few months indicates that the brand has managed a 53% jump in sales since May 2025, when registrations were only 11,664 units.

The other good story is Vida, Hero MotoCorp’s electric scooter arm. It managed the fourth place with registrations of 13,315 units, a 26.3% jump in sales. Vida’s growth should be seen in the light of previous under-performance and the brand making up for lost ground. Hero has one of the largest retail footprints for any two-wheeler manufacturer, and Vida’s poor sales were a result of the organisation not taking the brand seriously.